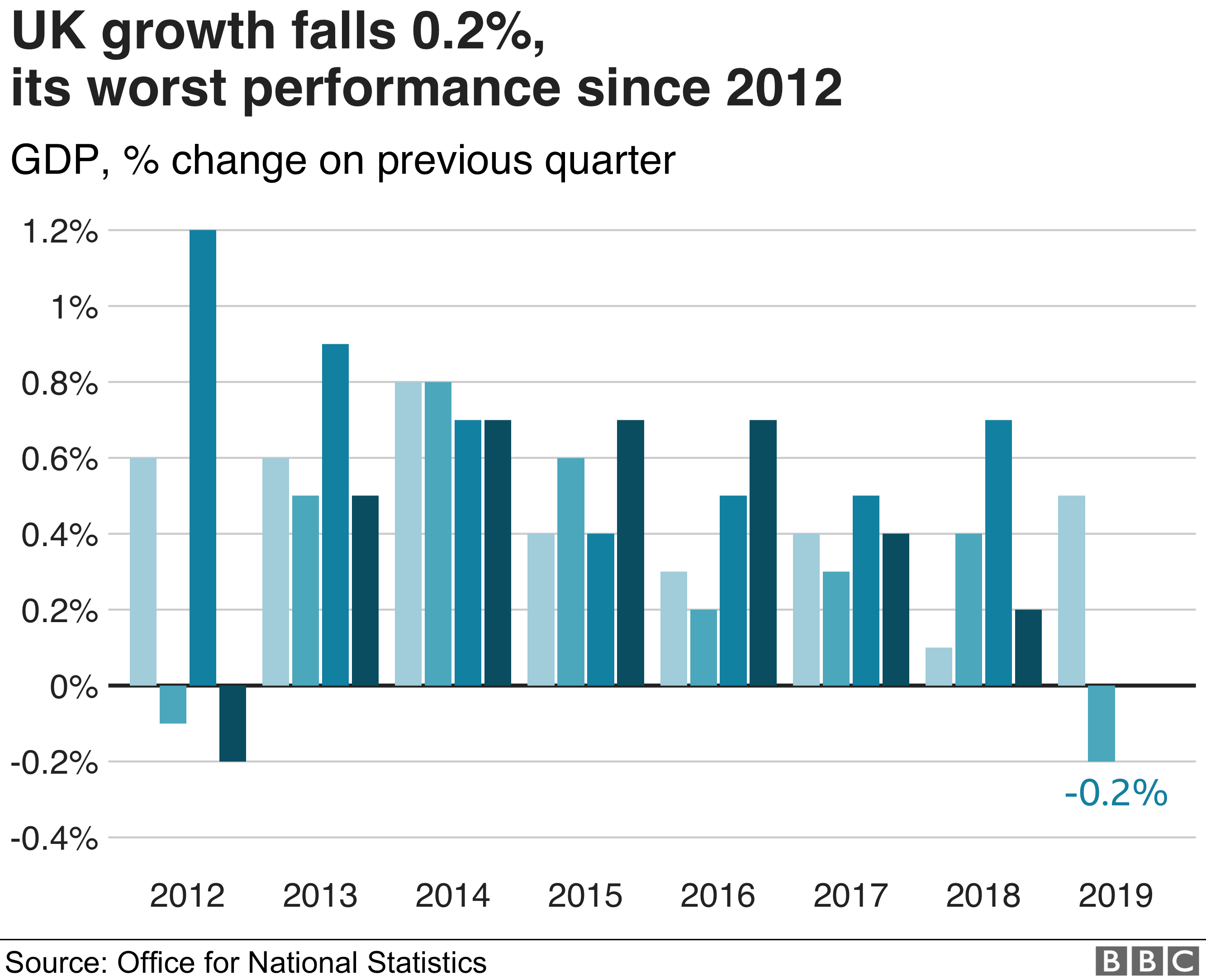

UK Economy Shrinks for the First Time Since 2012

The

chancellor has told the BBC that he does not expect the UK to slide into

recession after data showed the economy shrank by 0.2% between April and June.

Sajid Javid

was speaking after the Office for National Statistics said the economy had

contracted for the first time since 2012.

The surprise

decline came after Brexit stockpiles were unwound and the car industry

implemented shutdowns.

The pound

slipped when the data was released, raising fears of a recession.

Rob

Kent-Smith, head of GDP at the ONS, said manufacturing output fell and the

construction sector weakened.

A recession

occurs when the economy contracts in two consecutive quarters. This is the

first contraction since the fourth quarter of 2012.

Economists

had not been forecasting a contraction in the economy in the second quarter,

but had expected it to stagnate, with the consensus forecast for 0% growth.

The

economy had shown 0.5% growth in the first quarter after

manufacturers' stockpiling ahead of Brexit helped to boost output, when the

manufacturing sector recorded its biggest quarter rise since the 1980s.

The ONS said

GDP had been "particularly volatile" so far this year because of the

changes to activity sparked by the original Brexit date of 29 March.

The

statistics body said its latest figures showed that those increased stockpiles

had been partly run down in the second quarter and that a number of car

manufacturers had brought forward their annual shutdowns to April as part of

contingency planning, which also hit growth.

Mr

Kent-Smith said: "Manufacturing output fell back after a strong start to

the year, with production brought forward ahead of the UK's original departure

date from the EU."

He added

that "the often-dominant service sector delivered virtually no growth at

all".

Mr Javid

told the BBC: "I am not expecting a recession at all. And in fact, don't

take my word for it. There's not a single leading forecaster out there that is

expecting a recession, the independent Bank of England is not expecting a

recession. And that's because they know that the fundamentals remain

strong."

The Bank

said earlier this month it expects the economy to grow by 1.3% this year,

down from a previous projection of 1.5% in May.

Asked about

the impact of Brexit, he said: "We saw some significant stockpiling by

British businesses in anticipation of the Brexit that never was, and now

they're using those stockpiles, they're coming down.

"Of

course, there are businesses out there that are taking Brexit into account when

they're making decisions."

He said:

"No one will be surprised by today's figures."

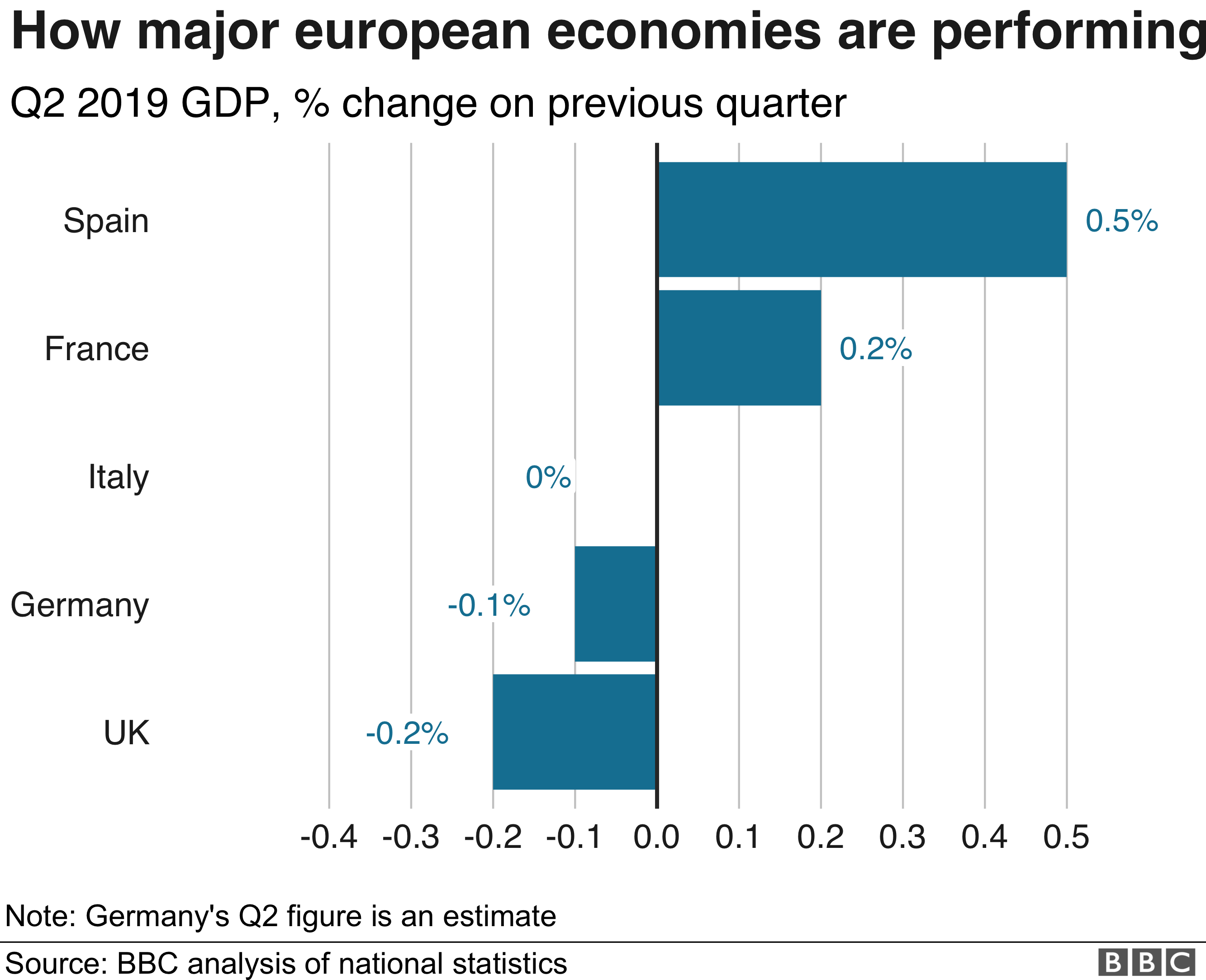

The data

comes at a time when there are signs other economies are slowing. For instance,

data on Friday showed that French industrial output fell more than expected in

June.

Mr Javid

said: "This is a challenging period across the global economy, with growth

slowing in many countries.

"But

the fundamentals of the British economy are strong - wages are growing,

employment is at a record high and we're forecast to grow faster than Germany,

Italy and Japan this year."

But John

McDonnell, the shadow chancellor, said the "dismal economic figures are a

direct result of Tory incompetence".

"The

Tories' Brexit bungling, including Boris Johnson now taking us towards no-deal,

is breaking the economy."

The Liberal

Democrats were also concerned about the impact of a no-deal Brexit.

"Pursuing

a no-deal Brexit is a political choice without a mandate: these figures show

people's jobs and livelihoods are being sacrificed at the altar of political

extremism, " said Chuka Umunna, the party's Treasury and business

spokesperson.

Mr Javid

said the best way to deal with Brexit uncertainty was to leave the EU on 31

October, with or without a deal.

"We're

seeing volatility in the figures and one of the best ways to actually end this

volatility is to bring certainty around Brexit and make sure we leave on 31

October."

The

employers' body, the CBI, said the contraction was "concerning".

Alpesh

Paleja, CBI lead economist, said: "Growth has been pushed down by an

unwind of stockpiling and car manufacturers shifting their seasonal shutdowns.

"Nonetheless,

it's clear from our business surveys that underlying momentum remains lukewarm,

choked by a combination of slower global growth and Brexit uncertainty.

"As a

result, business sentiment is dire."

The

Federation of Small Businesses - which is calling for an emergency Budget -

said that if the Treasury delays action until after 31 October, the date for

Brexit, its efforts are likely to prove too little, too late.

"Time

is of the essence. Unless the chancellor steps in imminently with radical action,

we could be heading for a chaotic autumn - and a very long winter," said

the FSB's policy and advocacy chairman, Martin McTague.

Chris

Williamson, chief business economist at IHS Markit, said the data showed

"an economy in decline and skirting with recession as headwinds from

slower global growth are exacerbated by a Brexit-related paralysis".

Geoffrey Yu

of UBS Wealth Management said that while the global picture was "becoming

more gloomy", anyone looking for positive signs for the economy could look

to "robust private consumption, reflecting a healthy labour market".

Household

spending rose 0.5% on the quarter. Samuel Tombs, chief UK economist at Pantheon

Macroeconomics, agreed that household spending was still growing at a

"robust rate" and said it was not time to panic.

He said the

stockpiling was dragging on the economy, which was "sluggish and had not

stalled".

The pound -

which has been at two-year lows on Brexit uncertainty - fell 0.2% against the

dollar to $1.2106.

The currency

also falls if there are expectations that interest rates will be cut. Mr Tombs

said the market now sees a 70% chance of an interest rate cut in January, when

Mark Carney is due to leave as the Bank of England's governor.

FROM bbc.com/news/business-

No comments